|

From

Buyincomeproperties.com Land Investment

In last week°Įs article, we discussed how substantial profits could be made by investing where baby boomers may want to relocate or buy a second home. This seemed to confuse readers since they were thinking that our web site is about preconstruction and preconstruction to them means buying condos°≠°≠ In this article, I hope to broaden your horizons considerably. Unlike many people, I have a very broad definition of preconstruction investing which can be summarized as follows:

Preconstruction investing is the pursuit of real estate projects that offer the opportunity to ride rapidly increasing prices over time without the need to put tenants in place to defray costs. Since no tenants are involved, this opens the possibility to making investments in locales that are far removed from where you live.

If you adopt this point of view, then a whole world of ďalternative?preconstruction investments opens up to you. Today, we are going to look at one specific type of investment: investing in developing land projects where baby boomers might want to retire or own a second home.

Before we get into the specifics, letís talk about what all investors want: Low risk Good investment returns; and Minimal use of their capital; Quite frankly, these 3 reasons are what got me into preconstruction real estate investing in the first place. Now letís see how these might be achieved on a purchase of investment land that we believe to be VERY desirable to baby boomers.

Suppose we are considering the purchase of a piece of property for speculation of future returns. If, like me, you believe in the impact of the baby boomers, then you will do 3 things to control your risk: 1. Carefully select a land project where you are solidly convinced that baby boomers will want to possess it at any costs; 2. Make sure that you believe that baby boomers will be AWARE of this project in the future due to somebodyís marketing; and 3. Manage your finances and investment portfolio so that if you are wrong and you do take a loss, it is not catastrophic to you. For the time being, letís assume that you have met these conditions on a project and now you are ready to analyze your returns and your use of capital.

Now we have to resort to hard analysis. Letís look at the following ASSUMPTIONS: 1. The land project is assumed to increase at least 25%/Yr in price; 2. We plan on holding the land for 2 yrs and then resell. 3. $200,000 purchase price with $5,000 in closing costs. 4. Annual taxes/association fees of 1%.

Letís take a look at three cases in a spreadsheet format to how things might turn out under this scenario. Case 1: 10% down payment, interest only, all payments made by BUYER. Case 2: 10% down payment, interest only, all payments made by SELLER. Case 3: 5% down payment, interest only, all payments made by SELLER.

Cases 2 and 3 require a bit of explanation. There are some early stage land projects available where the developer will take a percentage of your purchase price and escrow an amount that will make your payments for a period of time---- typically 2 years. This means that during your 2 year hold, you would only pay taxes and association fees. To enter this in the spreadsheet, we just show a 0% rate during the holding period. If you scroll down, you can review the performance of each case. It may surprise you that even under Case 1, where you paid in a total of $48,600 out of pocket, you still see a return on investment of 127%! That equates to 51% annual return on investment. Compare that to what your friendly banker is giving you in your CD.

For many investors, beginning or not, they would prefer not to have to put in that much money so letís look at Case 2 where the developer has escrowed 2 years worth of payments. In this case, we invest a total of $29,000 with a total, out the door profit before taxes of $81,625 thus providing a total return of 281%. If you then extend that to Case 3, where only 5% down is required, then the return goes off the charts.

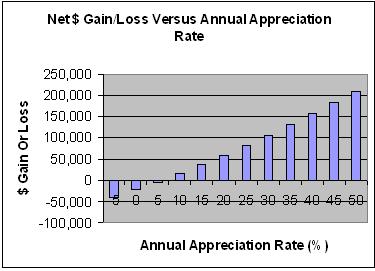

The biggest variable here is our assumed appreciation rate: we choose 25%. Of course this depends on the general market, the local market, the project, etc. and NOBODY can predict this going forward. So what happens as the assumed level goes from -5%/Yr to 50%/Yr which hopefully will be a good bracket. The chart below shows the results.

In the very near future, there will be some opportunities on ďpreconstruction?land similar to what is described here! If this type of investment may be of interest to you, then your job becomes deciding these 3 factors: Is it low risk for YOU? Is it good investment returns for YOU? Is it an acceptable use of YOUR capital? To assist, we will try to present enough information about the project/locale to for you to assess your own risk and projected growth rates: what you assume may be quite different from what I assume and that is ok. To assist with the other pieces, we have provided a copy of the spreadsheet used in this article so you can make your own assumptions and analysis. Click Here to get the spreadsheet at no cost. Dr. Chris Anderson is a co-founder of http://www.GetPreconstructionDeals.com and is referenced in many venues including the New York Times and USA Today. Download his free, 30+ page preconstruction investing ebook today at Get Preconstruction e-Book © Copyright 2004 by Buyincomeproperties..com |