In last week°Įs article, we discussed how substantial profits could be made by investing where baby boomers may want to relocate or buy a second home. This seemed to confuse readers since they were thinking that our web site is about preconstruction and preconstruction to them means buying condos°≠°≠ In this article, I hope to broaden your horizons considerably.

Unlike many people, I have a very broad definition of

preconstruction investing which can be summarized as

follows:

Preconstruction investing is the pursuit of real

estate projects that offer the opportunity to ride

rapidly increasing prices over time without the need

to put tenants in place to defray costs. Since no

tenants are involved, this opens the possibility to

making investments in locales that are far removed from

where you live.

If you adopt this point of view, then a whole world of

ďalternative?preconstruction investments opens up to

you. Today, we are going to look at one specific type

of investment: investing in developing land projects

where baby boomers might want to retire or own a second

home.

Before we get into the specifics, letís talk about what

all investors want:

Low risk

Good investment returns; and

Minimal use of their capital;

Quite frankly, these 3 reasons are what got me into

preconstruction real estate investing in the first

place. Now letís see how these might be achieved on a

purchase of investment land that we believe to be VERY

desirable to baby boomers.

Suppose we are considering the purchase of a piece of

property for speculation of future returns. If, like

me, you believe in the impact of the baby boomers, then

you will do 3 things to control your risk:

1.

Carefully select a land project where you are

solidly convinced that baby boomers will want to possess

it at any costs;

2.

Make sure that you believe that baby boomers will

be AWARE of this project in the future due to somebodyís

marketing; and

3.

Manage your finances and investment portfolio so

that if you are wrong and you do take a loss, it is not

catastrophic to you.

For the time being, letís assume that you have met these

conditions on a project and now you are ready to analyze

your returns and your use of capital.

Now we have to resort to hard analysis. Letís look at

the following ASSUMPTIONS:

1.

The land project is assumed to increase at least

25%/Yr in price;

2.

We plan on holding the land for 2 yrs and then

resell.

3.

$200,000 purchase price with $5,000 in closing

costs.

4.

Annual taxes/association fees of 1%.

Letís take a look at three cases in a spreadsheet format

to how things might turn out under this scenario.

Case 1: 10% down payment, interest only, all payments

made by BUYER.

Case 2: 10% down payment, interest only, all payments

made by SELLER.

Case 3: 5% down payment, interest only, all payments

made by SELLER.

Cases 2 and 3 require a bit of explanation. There are

some early stage land projects available where the

developer will take a percentage of your purchase price

and escrow an amount that will make your payments for a

period of time---- typically 2 years. This means that

during your 2 year hold, you would only pay taxes and

association fees. To enter this in the spreadsheet,

we just show a 0% rate during the holding period.

If you scroll down, you can review the performance of

each case. It may surprise you that even under Case 1,

where you paid in a total of $48,600 out of pocket, you

still see a return on investment of 127%! That equates

to 51% annual return on investment. Compare that to

what your friendly banker is giving you in your CD.

For many investors, beginning or not, they would prefer

not to have to put in that much money so letís look at

Case 2 where the developer has escrowed 2 years worth of

payments. In this case, we invest a total of $29,000

with a total, out the door profit before taxes of

$81,625 thus providing a total return of 281%. If you

then extend that to Case 3, where only 5% down is

required, then the return goes off the charts.

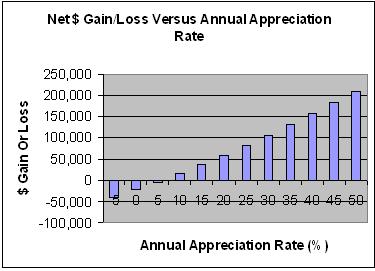

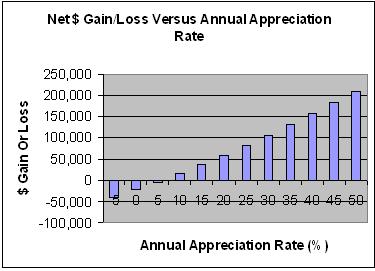

The biggest variable here is our assumed appreciation

rate: we choose 25%. Of course this depends on the

general market, the local market, the project, etc. and

NOBODY can predict this going forward. So what happens

as the assumed level goes from -5%/Yr to 50%/Yr which

hopefully will be a good bracket. The chart below shows

the results.

In the very near future, there will be some

opportunities on ďpreconstruction?land similar to what

is described here! If this type of investment may be of

interest to you, then your job becomes deciding these 3

factors:

Is it low risk for YOU?

Is it good investment returns for YOU?

Is it an acceptable use of YOUR capital?

To assist, we will try to present enough information

about the project/locale to for you to assess your own

risk and projected growth rates: what you assume may be

quite different from what I assume and that is ok. To

assist with the other pieces, we have provided a copy of

the spreadsheet used in this article so you can make

your own assumptions and analysis.

Click Here to get the

spreadsheet at no cost.

Dr. Chris Anderson is a co-founder of

http://www.GetPreconstructionDeals.com and is referenced in many venues including the New York Times and USA Today. Download his free, 30+ page preconstruction investing ebook today at

Get Preconstruction e-Book

Do you own real estate articles or stories and want to share with other investors?

You have chance to win

$100 Amazon Gift Certificates. We will give

away 3 prizes for top authors each month!

Email your articles or stories to:

articles@buyincomeproperties.com

© Copyright 2001 - 2010 by

BuyIncomeProperties.com

Visit

Real Estate Forums

for every real estate investing topics!

Enter Here

Top of Page